Running a business is exciting — but let’s be real, managing finances isn’t always the fun part. Between tracking expenses, keeping receipts, and monitoring income, it can quickly get overwhelming. That’s where QuickBooks comes in.

QuickBooks is one of the most popular accounting tools for small and medium-sized businesses (SMEs), and for good reason. It makes managing your business finances simple, accurate, and stress-free.

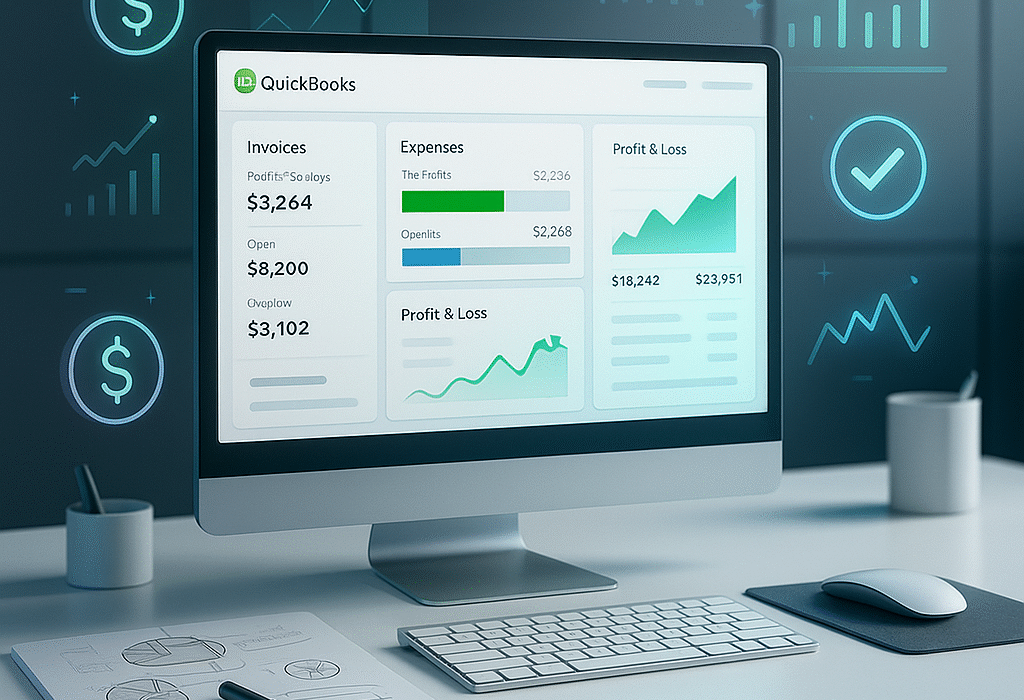

1. Easy Income & Expense Tracking

No more messy spreadsheets. QuickBooks automatically categorizes income and expenses, so you know exactly where your money is going. Whether it’s a client payment or a recurring bill, everything stays organized in one place.

2. Real-Time Financial Insights

QuickBooks gives you dashboards and reports that show your cash flow, profit, and losses in real time. This makes it easier to make smarter decisions — like when to reinvest or cut costs.

3. Simple Invoicing & Payments

With QuickBooks, you can send professional invoices to clients and even accept payments online. You’ll get paid faster, and your invoices automatically sync with your accounts.

4. Tax-Ready in Minutes

Tax season can be a headache for business owners. QuickBooks keeps all your financial data organized, so when it’s time to file taxes, everything is ready — no scrambling through piles of receipts.

5. Scales With Your Business

Whether you’re a freelancer, a startup, or an established SME, QuickBooks grows with you. You can start with the basics and add features like payroll, inventory tracking, or advanced reporting as your business expands.

QuickBooks takes the complexity out of financial management. By automating expense tracking, simplifying invoicing, and providing real-time insights, it helps you focus less on spreadsheets and more on growing your business.